Document fraud is a growing threat, costing the global economy billions of dollars annually. As counterfeit documents become more sophisticated, traditional verification methods are proving insufficient. Businesses are increasingly turning to advanced technology to protect themselves. document fraud detection software offers a powerful solution, automating the verification of IDs, certificates, and other sensitive papers to ensure authenticity and mitigate risk. This guide explores the essential aspects of this technology, from how it works to the significant benefits it provides.

What is document fraud detection software?

Document fraud detection software is a specialized tool designed to automatically verify the authenticity of various documents. It uses a combination of advanced technologies, including artificial intelligence (AI), machine learning (ML), and optical character recognition (OCR), to analyze a document’s physical and digital features. The software scans for inconsistencies, signs of tampering, and other red flags that might indicate fraud.

Businesses rely on an online notary to streamline contracts, affidavits, and agreements. Remote notarization eliminates delays and improves workflow efficiency. It provides a secure, verified process that enhances trust and reduces logistical challenges, making it a preferred option for modern professionals handling legal documents.

This technology can be applied to a wide range of documents, including:

- Identity Documents: Passports, driver’s licenses, and national ID cards.

- Financial Documents: Bank statements, pay stubs, and tax forms.

- Educational and Professional Certificates: Diplomas, degrees, and licenses.

- Legal and Business Documents: Contracts, invoices, and proof of address.

By automating the verification process, this software provides a scalable and reliable way for organizations to ensure the documents they receive are genuine.

How does automated document verification work?

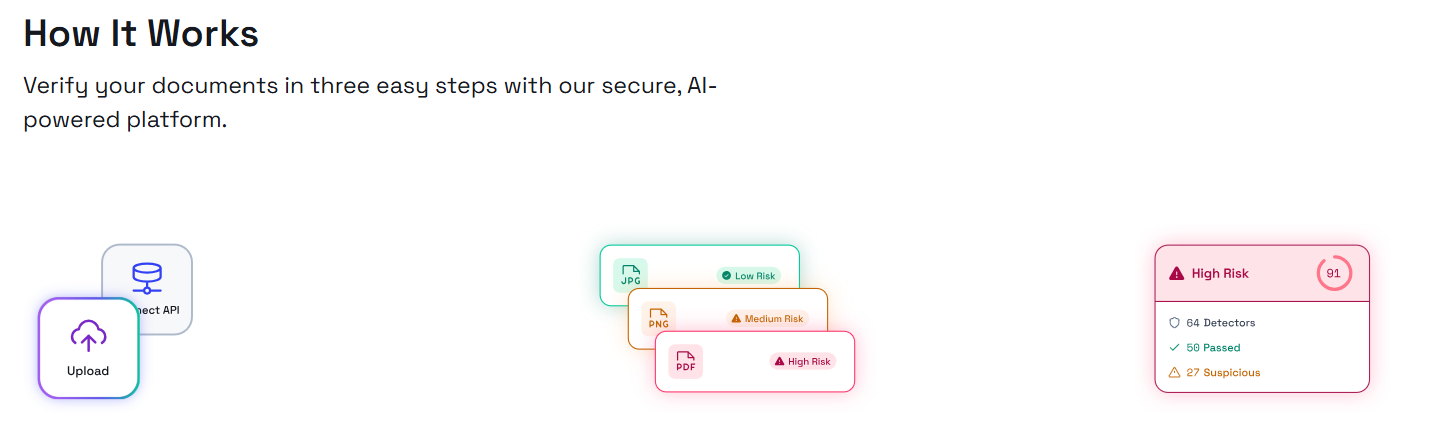

Automated document verification software follows a multi-step process to analyze and validate documents with remarkable speed and accuracy.

- Image Capture: The process begins when a user submits a digital image of their document, usually captured with a smartphone camera or a scanner. The quality of this initial image is crucial for accurate analysis.

- Data Extraction: The software uses Optical Character Recognition (OCR) to extract text and data from the image. This includes names, dates, document numbers, and other relevant information.

- Authenticity Checks: This is the core of the verification process. The software performs hundreds of checks in seconds, comparing the document against a vast database of known document templates and security features. Key checks include:

- Visual Inspection: Analyzing the layout, fonts, and logos to ensure they match the official template for that specific document type.

- Security Feature Analysis: Looking for holograms, watermarks, microprinting, and other security features unique to legitimate documents.

- Data Consistency: Cross-referencing extracted data to ensure consistency. For example, it checks if the date of birth aligns with the age listed or if the document number format is correct.

- Tampering Detection: The software inspects the document for signs of alteration. This can include detecting pixel inconsistencies that suggest digital editing, identifying font mismatches from a “find and replace” attempt, or spotting physical alterations.

- Result and Reporting: After completing the analysis, the software provides a clear result: verified, not verified, or requires manual review. This immediate feedback allows businesses to make quick and informed decisions.

Why is document fraud a growing concern for businesses?

Document fraud is no longer a niche problem; it’s a mainstream threat affecting organizations across all sectors. The accessibility of sophisticated editing software and high-quality printers has made it easier than ever for criminals to create convincing fake documents.

Recent trends show a significant rise in fraudulent activities. For instance, financial institutions report that fraud involving falsified bank statements and pay stubs has increased substantially, as individuals seek to secure loans or mortgages with inflated income figures. Similarly, the rental market has seen a surge in applicants using fake IDs and proof-of-income documents.

This rise in fraud poses several risks to businesses:

- Financial Losses: Accepting fraudulent documents can lead to direct financial losses from bad loans, unpaid rent, or chargebacks.

- Reputational Damage: Being associated with fraud can erode customer trust and damage a company’s brand reputation.

- Compliance Penalties: Many industries are subject to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Failing to properly verify identities can result in hefty fines and legal action.

- Operational Inefficiencies: Manual document review is slow, costly, and prone to human error, creating bottlenecks in customer onboarding and other critical processes.

What are the main benefits of using document fraud detection software?

Integrating automated document verification software into your business operations can deliver substantial benefits, enhancing security, efficiency, and compliance.

Strengthened Security and Fraud Prevention

The most significant benefit is the enhanced ability to detect and prevent fraud. This software is trained on millions of data points and can identify subtle inconsistencies that a human reviewer would likely miss. By accurately spotting fake IDs, altered bank statements, and counterfeit certificates, you can protect your business from financial losses and security breaches before they happen. This proactive approach to security is essential.

Increased Operational Efficiency

Manual document verification is a time-consuming and resource-intensive task. Employees must be trained to recognize security features on hundreds of different document types from around the world—a near-impossible feat. Document fraud detection software automates this entire process, delivering verification results in seconds. This allows your team to focus on more strategic, high-value tasks instead of getting bogged down in repetitive administrative work. The result is a faster, leaner, and more productive operation.

Improved Customer Experience

In a competitive market, a smooth and fast customer onboarding process is a key differentiator. Lengthy verification procedures can lead to high drop-off rates, as customers abandon the process out of frustration. Automated document verification provides near-instant results, allowing customers to get approved for services quickly and seamlessly. This positive first impression can lead to greater customer satisfaction and loyalty.

Enhanced Compliance and Risk Management

For businesses in regulated industries like finance, real estate, and healthcare, compliance with KYC and AML regulations is non-negotiable. Document verification software provides a robust and auditable trail for every check performed, helping you meet your legal obligations. It standardizes the verification process, reducing the risk of human error and ensuring that your compliance procedures are consistently applied across the board. This helps you avoid steep penalties and legal troubles associated with non-compliance.

Greater Scalability

As your business grows, the volume of documents you need to verify will increase. Manually scaling your verification team to meet this demand is expensive and inefficient. An automated solution, on the other hand, can handle thousands of verifications per day without a proportional increase in cost or resources. This scalability ensures that your security and compliance standards do not falter as your business expands.

Preparing Your Organization for the Future

The landscape of fraud is constantly evolving, and businesses must adapt to stay ahead. Document fraud detection software is no longer a luxury but a necessity for any organization that handles sensitive documents. By leveraging the power of AI and automation, you can create a more secure, efficient, and compliant business environment. This technology empowers you to make smarter decisions, protect your assets, and build a foundation of trust with your customers. Adopting these tools is a critical step in future-proofing your operations against the sophisticated threats of tomorrow.

Leave a Reply